How much do Lyft drivers make?

Everything you need to know about expenses, drivers tax deduction and Lyft Accelerate

Rewards

How Much Do Lyft Drivers Actually Make?

If you have already read our article about how much are lyft drivers paid, you already know the lyft pay structure for drivers and you already know that it varies from city to city and from State to State. It’s important to consider that a part of a Lyft’s income comes from:

-

lyft Pay Stucture

-

Lyft Daily Driver Bonus & Incentives. (lyft gives bonus if you drive at certain times of the day)

In this article we want to focus our attention on all those hidden expenses that you will sustain after signing up for lyft and above all we want to give good suggestions to optimize them.

How much are Lyft driver expenses?

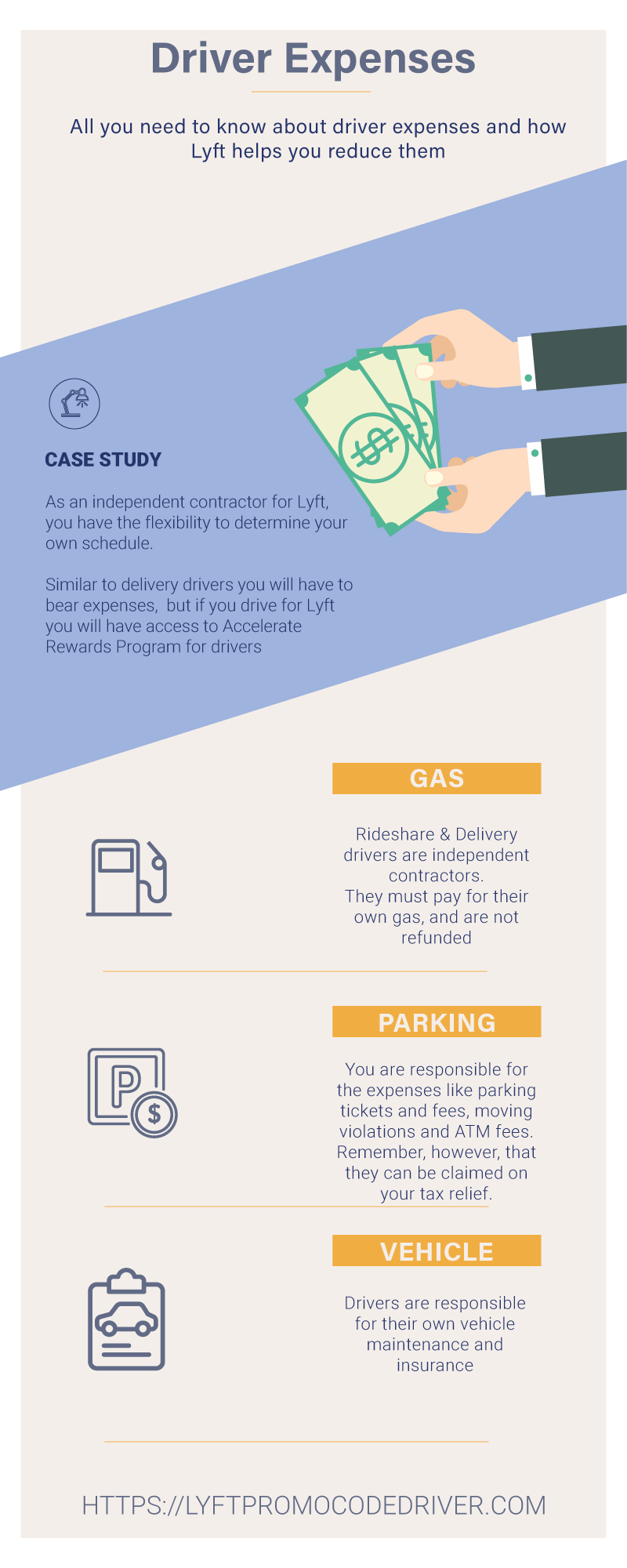

Whether it's rideshare or delivery, if you drive a personal vehicle for business you will have expenses. Some cars like the hybrid cars are more suited to rideshare driving. Not all people who sign for lyft want or have the possibility to change the car. We have made a list of the expenses you will have as Lyft drivers and we found some simple ways to limit them.

Here is a checklist of all hidden expenses, which will help you understand how really a Postmate make.

-

Vehicle: whether you have bought or lease your vehicle, the amount that you have to pay represents the biggest expense.

-

Insurance: lyft have insurance but the insurance coverage for lyft drivers is minimal. You can check with a rideshare insurance agent to be sure you are correctly insured...

-

Gas: Rideshare & Delivery drivers are independent contractors. They must pay for their own gas, and are not refunded.

-

Parking: You are responsible for the expenses like parking tickets and fees, moving violations and ATM fees. Remember, however, that they can be claimed on your tax relief.

-

Vehicle maintenance: drivers are responsible for their own vehicle maintenance.

It is not possible to quantify all these expenses because rates of parking, gas and insurance can vary widely by location, age

lyft Driver Expenses Infographic

How to save money when you are a Lyft Driver

I know, everyday life can be very stressful and demanding, but these small things will help you make your car more efficient, keep it in good conditions, delay big maintenance and then save money. Protect your investment and make it as safe as possible. Keeping your car in good condition can be as simple as checking fluids or tire pressure.

How to Extend the Life of your Car [Checklist]

-

Monitor the thickness of the brake pads and do not let them consume up to the metal: This would cause damage to the brake discs if not to the jaws. Replacing the discs and the jaws is much more expensive than replacing the pads. Nothing is better than cleaning the pad while it is still in the car. The friction between the pad and the disc will eliminate any external substance almost immediately.

-

Change the tires on rotation: Changing the position of the tires is very important and reduces the irregularities and lacerations on the tread, extending the life of the tire. The recommended rotation cycle is a change twice a year or every 6,000 miles. Rotate diagonally, the front right with the left rear and the front left with the right rear. However, this model may change depending on the vehicle transmission and the type of tires. Your manual will contain information about it. Remember that some tires (especially sports cars) are directional, that is, they rotate in one direction. They usually have a big arrow on the side to indicate it.

-

Keep tire pressure: Poorly inflated tires reduce tire life by 15% and increase fuel consumption by 10%. Inflating tires is probably the simplest operation, and many stores sell very cheap manometers. Controlling the pressure every time you make petrol will reduce tire wear and prevent these problems. Monitor the tread with a coin. Insert the coin under the tread. If you can see the whole character's head on the coin, then it will be necessary to change the tires.

-

Wash your car: salt on roads, sewage debris and pollution can cause structural problems that require expensive work. Without regular cleaning, you can start to notice the rust on the bottom of the doors after four years. Another three or four years and the corrosion will affect the internal components, such as the brake wires. Rust repair work can cost thousands of Euros if you do not wash your car often, especially if you live in seaside areas where sand on the roads or morning dew can contain a lot of saltiness.

Lyft Tax Deductions

As drivers of rideshare companies like Lyft or Uber, you are considered self-employed and you can claim deductions for work-related expenses saving money on your taxes.

We are not providing tax advice. Lyft is a driver friendly company.

They’ve have a Accelerate Rewards programs for drivers. This program provide free tax preparation during tax season and discounted expense management year-round. It will be able to provide assistance with your tax return and give you accurate explanations on the different methods of deduction:

-

The standard mileage rate

-

The actual expenses

Find below some examples of commonly accepted deductions.

Checklist of deductible expenses for lyft Drivers

We have prepared for you a list of all deductible expenses and if you do not use a track miles, maybe you should start.

-

Car-Related Expenses

As a lyft driver, miles driven for work can be deducted from taxes. In terms of mileage self-employed people have access to the highest deduction rate and fewest restrictions.

It exists different mileage tracking app, MileIQ is one of these and is available for Iphone or Android

-

Car Interest Payments

Loan interest is tax deductible if it’s a Business Vehicle. As delivery driver you can write off interest on your car loan payments. If you use your car for business & personal, you can only deduct the business portion. (50% of the interest if you use the car 50% of the time for business and 50% for personal use)

-

Insurance

You are self-employed and have to drive a car for your business. Automobile insurance premiums are tax deductible for the business portion.

-

Gas

You can claim gas on taxes as a deductible business expense, of course you can deduct only the gas costs that is business related.

-

Cell Phone

If you own a phone that’s completely dedicated to your work, 100% of the cost of the phone and the monthly plan is deductible. If your new cell phone acts as both your business and personal phone, you are only allowed to deduct the portion used for business from your taxable income.

-

Parking and Tolls

The parking fees (garages and meters) and tolls incurred while working are deductible. The IRS doesn’t require proof of parking and toll expenses at the time of filing but it requires you keep documentation.

Accelerate Rewards for drivers

Once you become Lyft driver you will have access to the Lyft redwards program. This program offers a number of advantages to Lyft drivers and is divided into three different levels:

-

Silver Rewards

Give 10 rides in 3 months to qualify

-

Save $0.05 per Gallon (Shell Fuel)

-

Discount roadside assistance (Allstate)

-

Discount mileage and expense tracking (Quickbooks)

-

$25 off (Doctor on Demand)

-

Find affordable health insurance (eHealth)

-

-

Gold Rewards

Give 250 rides in 3 months to qualify

-

Lyft Amp

-

Save on car rapair

-

Save on movie tickets

-

Save on Fitness and other wellness partners

-

Platinum Rewards

Give 600 rides in 3 months to qualify

-

Roadside Radar

-

Save 0.07 per Gallon (Shell Fuel)

-

Free roadside assistance (Allstate)

-

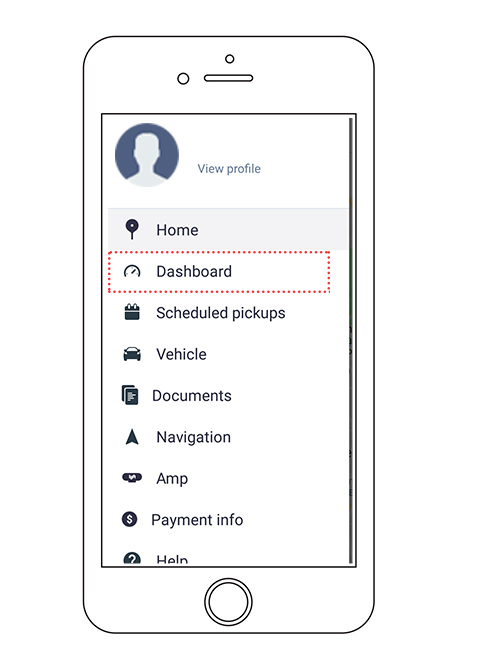

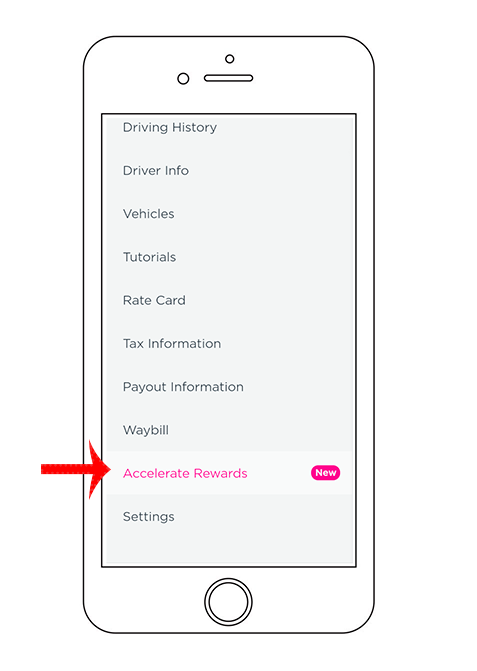

How can I verify my Lyft Accelerate reward

This is one of the latest news from the Lyft App. Now you can check and access to Accelerate rewards directly from the Dashbord of your Lyft Driver App.

Last Words

Working as a lyft driver is a part-time, full-time job and a side income opportunity. As independent contactor you can choose hours that work for you. Take time off, or work extra when it suits you. Lyft is a driver friendly company, you can get paid daily and take benefit of Lyft Accelerate Rewards Program. Following some precaution, you will optimize your earnings.